One of the fallouts post the Archegos fire sale of assets will be not just how much leverage banks can extend to individual funds but also for hedge funds to evaluate their prime brokerage banking relationships. Memories of 2008 stay fresh and no fund wants their banking counterpart caught up in a liquidity scandal. 2021 is shaping up to be another seismic year for hedge funds. In this month’s Some Thoughts we document some interesting changes in the behaviour and approach to investing in hedge funds over the past 12 months. Not surprisingly last year was one of the lowest on record for European hedge fund launches but there is a raft of new high-profile launches coming this year.

Also this month we note the success of what3words post their successful Series C1 as well as the continued value in Woodford’s legacy UK private assets. For the first time we report on Ilmenite which, like Lithium and Uranium, is another overlooked specialist commodity, and identify which stock to own to play it.

First off, we start with the value in buying SPACs at a discount to trust value and our recently published Ocean Wall SPAC report:

SPAC – no downside for buying below trust value

The size and pace of issuance has begun to depress the SPAC market with $75+bn of SPACs now trading at attractive YTM. Recently we have seen SPACs trade down to an 8% discount to trust. There is no ultimate downside for purchasing securities below trust.

At current levels, we believe SPACs yield to trust offer comparable rates of return to “safe” rate of return merger arbitrage situations with vastly superior downside protection and materially more upside optionality relating to both time and value.

A partner of ours in the US is building a SPAC portfolio at a discount to trust with significant upside option value on timing and value realization. They are targeting 50-150 names with a minimum of 40, targeting c.2% unlevered YTW. Position sizes are capped at 4.5% on average (closer to 2.0-2.5% to ensure liquidity). They have quantitatively screened out issuers with low SPAC raises and/or those that are required to issue rights or full warrants. From a qualitative side they have also excluded sponsors with lacklustre credentials; so the portfolio comprises SPAC sponsors who are either repeat issuers or have strong credentials in prior corporate leadership or cross-over public/private investing role and a diversified sector focus.

SPACs have generally taken 12-15 months to announce deals, but the recent popularity and understanding within the private founder community is seeing this significantly reduce to <240 days. Since 2013 87% of SPACs have reached a deal.

The beauty about backing a fund buying screened high-quality SPACs is that you have no downside and a widely diversified portfolio. We would be happy to introduce you to our US partner.

SPACS – London Calling

Following up on our talk last month with Murray Roos of the London Stock Exchange, the Lord Hill recommendations in terms of flexibility to listing of ‘blank cheque’ vehicles and with SPACs dominating the new issue capital markets in the US, and creeping into Europe too, Ocean Wall has put together a brief overview of this vehicle and what it brings to each of the parties involved.

Amsterdam is already seeing an increase in interest and has launched 3 SPACs YTD. Feeling market pressure to act quickly the FCA announced on 31st March that they will be issuing a consultation paper shortly with the aim of changing new listing rules by early summer. One point of contention is likely to be the review of dual class share structured companies and their admission to the premium market. Fund managers have been extremely vocal about their dislike of these share structures and this may be something that they will push back on during the consultation process. The consultation process is expected to be completed by the end of April.

Hedge Fund Investing – the ‘new’ due diligence and investor focus

There have been some interesting changes in the behaviour and approach to investing in hedge funds over the past 12 months. Naturally we are happy to discuss in more detail:

-New DD checks and greater hurdles

In the absence of any physical DD being carried out, many investors are looking at alternative ways to gain a more comprehensive knowledge of managers.

One practice to have emerged is that of gaining references from other current investors that have carried out ‘in-person’ meetings with the PM/fund.

Some investors have incorporated “incubation periods”; after all DD has been completed and passed, funds are being placed into a 3 month observation period before any allocations can be made.

Many are restricting allocations to managers with longer lockup periods. For example, one Swiss investor has just changed barrier to entry so as to not allow new funds with locks over Quarterly and 45 days’ notice. Quantitative screens have got tougher, with particular focus on March 2020 performance. Investors are realistic about drawdowns but managers are being aggressively compared to each other on how they weathered March and reacted in the rest of 2020.

-UCITS structures

Investors are shifting their allocations and research to UCITS structures where possible. If a manager offers both HF and UCITS vehicles, the transparency and daily/weekly liquidity offered by the UCITS structure will be selected for investment.

Swiss and UK clients have been slower/more reluctant to adopt UCITS structures compared to the rest of Europe and have tried to remain in offshore vehicles. However, this resistance has been further challenged with the pandemic and dedicated HF houses are now allocating assets and resources to expanding their UCITS business to satisfy clients’ demand for transparency and liquidity.

-Exceptions to the rule

New managers are being considered if they are to replace underperforming funds in the same strategy, but if there is another manager in the same “bucket” that they are already invested with, then they will tend to increase the allocation to the alternate existing manager rather than source new names.

ESG has changed from “new age green thinking” to a dominant factor to many allocators. In the UCITS space, of the 1,388 funds launched just under 50% were ESG compliant/focused. A particular Swiss client has put ESG as the top priority for new manager selection and added that ESG managers will be added to every FoF portfolio.

Global Macro is another large draw at this time, strong performance in 2020 and the recognition of the skill set of managers in these environments has meant analysts and selectors are willing to look at new managers that will exploit this call.

New Fund Launches – Event leading the way

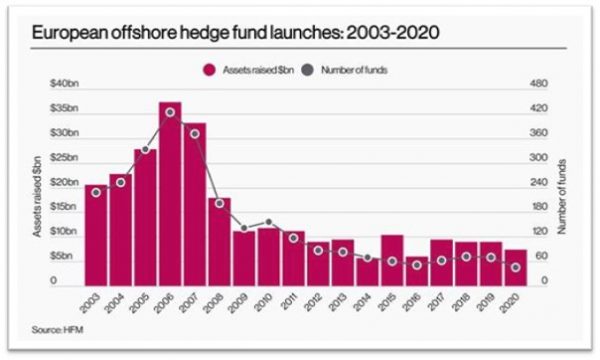

2020 was one of the lowest on record for European HF launches. Just 45 funds were launched in Europe in 2020 with $7.3bn AUM. The most launches by strategy were macro with 6 and $2.27bn and there were only two Event Driven funds launched last year in Europe.

The calibre of new launches in 2021 certainly paints a promising picture for the opportunity set in Europe:

Palliser – James Smith (ex Elliott)

Launching with $500m and two tickets $200/300m. Europe and Asia activist event

Sparta – Frank Tuil (ex Elliott)

European event launching with $500m

Nekton – Christophe Aurand (ex York)

Aim for $1bn+ with Christophe putting in $100m himself. Nekton will be equity long/short

Fifthdelta – Niall O’Keeffe & Tio Charbaghi (ex Citadel)

Ex Citadel head of European equities finished 3yr non-compete and is launching European equity long/short with $100m own money. Focus on Industrials and tech. July launch with $1-1.5bn

Pertento Capital – Eduardo Marques (ex Valiant Capital)

Equity long/short launching with $500m

Amundsen – Per Einar Ellefsen (ex Norges Bank IM)

Has raised $100m from NBIM to undertake market neutral strategies

Sand Grove – Simon Davies

Final closing of their successful event focussed Sand Grove Opportunities Fund

The map for a successful asset raise – what3words

The momentum of business take-up of what3words is really building with daily announcements of new partners. Amongst recent partnership announcements: Lincoln Motor Company (USA), Direct Couriers (Australia), Krush Brands (Dubai), outdooractive (Germany), Thames Travel (UK), BVG India Emergency Response (India) – giving a strong reflection of the global interest in this innovative company. Navigation tools using Apple Maps have also just been integrated to the what3words app.

The closing of their Series C raising finished with a flourish of involvement including a £12m investment from Ingka Group (IKEA) and several prestigious family offices. Ocean Wall were delighted to have been a part of this successful raise. In addition, ITV has also just announced a £2m stake in return for advertising inventory.

Value in the Woodford legacy – Schroders UK Public Private (SUPP)

In June last year we discussed dislocated holding company trades. One of the names, Neil Woodford’s Patient Capital Trust, was taken over by Schroders in December 2019 and renamed Schroder UK Public Private (SUPP). There are 42 names in the portfolio and the third largest is Oxford Nanopore (ONT). ONT has informed shareholders that it has started the process of preparing for a potential IPO. ONT currently expects the IPO to occur in H2 2021 on the LSE.

Oxford Nanopore made strong progress in 2020 with its technology further established as an industry standard for DNA/RNA sequencing with its use to track the global spread of SARS-CoV-2 (viral epidemiology), significant improvements achieved in accuracy (98.3% raw read) and throughput (10Tb+ on PromethION48), its Oxford MinION Building coming on-line with initial capacity to produce 1.2m+ sequencing flow cells per year (with headroom to triple this) and the move into applied markets through the launch of its Q-line of instruments and development and launch of LamPORE CE-marked COVID-19 test and £100m+ UK Govt contract marking its applied diagnostics entry.

Numis wrote recently that the closest peer to Oxford Nanopore is the US listed long read DNA sequencing firm Pacific Biosciences (PacBio). Factually, PacBio is currently valued at c.$5.5bn with end December cash of c.$320m. PacBio reported 2019 revenues of $91m at a gross margin of 38% ($35m gross profit), with its revenues falling c.13% in 2020 to$79m, while its gross margin improved to 41% ($32.6m gross profit), while consensus forecasts see 2021 revenue growth of c.67% to c.$131m. Oxford Nanopore’s last reported revenues for CY2019 were £52.1m ($66.7m) at a gross margin of 49% (£25.6m or$32.8m), with the company noting in its 2019 accounts a “large increase in revenue growth in 2020 to date, and the value of contracts in hand indicates further growth in revenue to be received over the course of the next 18 months”.

ONT is 15.75% of Schroder UK Public Private. SUPP trades at a 23.4% discount to its last reported NAV of 43.84p.

Ilmenite – the ‘ugly duckling’ commodity

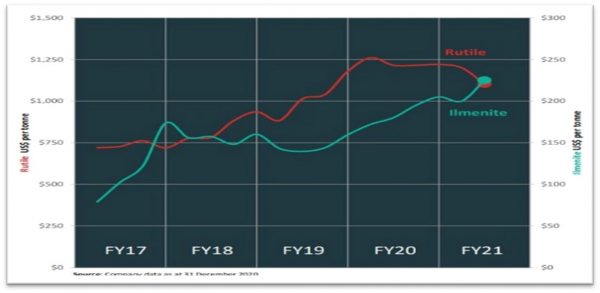

Another commodity seeing price increases due to supply shortfalls is the mineral salt: Ilmenite (titanium-iron oxide). Ilmenite is the main source of titanium dioxide which is used as a ‘whitening agent’ in paints, printing inks, fabrics, plastics, paper, etc.

Covid-19 has caused a slight blip in Western demand but Chinese pigment producers have maintained very high production levels – fuelling strong ilmenite demand and consequently pushing up prices. Covid has also caused some staffing problems at the mines but generally operations have been maintained. However, it has reduced new production coming online. Forecasters believe demand will continue to outpace supply and, therefore, market conditions are expected to remain tight; leading to further price gains in H2 2021.

Our favourite stock to benefit from this is the dual-listed, Base Resources (BSE LN). Having hit a low of 6.75p in February 2020, the stock has recovered – currently 14.25p – but with Numis estimating that on just 1x NAV it has an implied price of 30p it looks undervalued. (Note: there are two current analysts’ recommendations – both ‘Buy’ with a target price of 22p.)

The company surprised the market with a maiden dividend payment of AUD3.5cts (implying a 14% yield) with its year end results in mid-2020 and, again, the recent announcement of payment of an interim dividend alongside their interim results demonstrates strong management confidence in their cashflow. It had been expected that surplus cash would be held back to pay towards the development of Toliara but management has not deemed that necessary at this point and would indicate a very positive outlook on projected cashflow. Cash reserves were announced at AUD$75m (despite paying out AUD$30m in October for 2020 dividend). Debt reduced by US$50m in 2020 and the remaining US$25m is expected to be repaid by March 2021.

Base Resources is a well-established ‘pure’ mineral sands company listed on ASX and AIM. Based in Australia it has two main mining projects in Africa – the established Kwale Operations in Kenya and the developing Toliara Project in Madagascar. Mineral sands contain concentrated Titanium minerals – Titanium Dioxide – (including Rutile and Ilmenite) and Zircon – known as ‘heavy’ minerals. Used in a huge range of everyday consumer products, the majority produced go to into pigments for paint but are also used in paper, plastics, toothpaste, sun cream and ceramics. Demand is therefore linked to global GDP. Housing construction, health of emerging economies and ‘painting seasons’ are all key drivers of demand.

Kwale Operation in Kenya was purchased in 2010, developed and went into production in 2013 – on time, on budget and now producing well above estimates. The operation’s revenue to cash costs is 2.7x. Named as a Kenya Vision 2030 flagship project, Kwale already accounts for 65% of Kenya’s mining industry by mineral output. Expansion of the mine and work on mine life extension is a focus. Recent reports – end of March 2021 – from management state that their expansion focus will move away from some parts of the North Dune (too high slime content) towards the Bumamani deposit to the east. These studies are continuing at a pace and results are expected by the summer.

Toliara Project in Madagascar was purchased in 2018 and its 2020 PFS study results have shown it to be a world class asset. MPV estimated at US$671m, IRR 22% post tax real basis. Revenue to cash costs 3x. Thus meaning that Base Resources will have the 2 most profitable mineral sand operations in the world. Base Resources are currently negotiating final fiscal terms on this project.

ESG: Base Resources has adopted world class inclusive business practices (environmental, safety and community) seeking to minimise any negative impacts and maximise positive outcomes for employees, communities and host nations.

Kwali Operations continued producing throughout the pandemic and with prices in Titanium minerals continuing to rise this is a company with strong cashflow, an excellent asset base and these dividend payments, through a portion of Kwali cashflow, add a new dimension to the investment case.