Welcome to January 2022’s Some Thoughts. This month we discuss:

- A year in review for hedge funds

- Lithium in Review : Carbonate Prices, M&A, Chile’s political situation

- Uranium : Prices – a year in review, EU’s Sustainable Taxonomy, Kazatomprom’s busy Q4, SMR build times, China Nuclear plans and an update on YCA

- Event Driven investing and the outlook for 2022

- Plexo Capital a VC spun out from Google Ventures that has become a leading voice for diversity and inclusion in the space.

Hedge funds – a year in review

Globally, for the year, absolute returns were positive, but relative returns were not as strong. The top performing strategies from 2020 lagged in 2021 e.g., Equity L/S, TMT, Health Care while US Equity L/S upside capture vs S&P was the lowest since 2010. L/S alpha is on track for its worst year since 2010. The long alpha trades were the main detractors and the crowded longs also lagged.

In Europe, gross and net leverage across strategies was at or near peaks in early 2021 but declined into year-end. As in North America, growth positioning fell to recent lows as TMT positioning became moderated. Gross exposure reached its lowest, since 2010, in February and remains in the 7th percentile. The rotation toward defensives (Utilities) over Cyclicals (Int. / Specialty Retail) has continued since April. HFs are still overweight EU Growth compared to Value.

Lithium

Carbonate prices

Lithium carbonate prices in China extended their rally to 250,000 yuan per tonne in December, finishing the year on another all-time high, an unbelievable increase of over 400% since January. Prices were driven up throughout the year amid imbalances between current global supply levels and the metal’s surging demand. Pilbara Minerals – one of Australia’s biggest lithium producers – finished 2021 by slashing its shipping forecasts – further exacerbating the tight supply. S&P Global are forecasting a 5,000 mt LCE deficit for 2022 – compared to a surplus of 66,000 mt for 2020 and 8,000 mt deficit for 2021. This continuing, and likely increasing, deficit will keep prices high for the foreseeable future.

Electric vehicle deliveries in China are expected to total 3 million units this year, more than double last year, and forecasts point to more than 5 million sales in 2022. Meanwhile, bets on long-term scarcity of the light metal set EV manufacturers to race each other for long-term contracts, as lithium miners compete for contracts and face continued opposition from environmental groups.

M&A

M&A activity in 2021 was fierce. The action started in April 2021 with the Orocobre/Galaxy Aussie merger combining to form a $3.1bn super lithium company – the 5th largest in the world. Next followed the fight for Millennial Lithium and its Argentinian property with Ganfeng and CATL battling for several months, only to be pipped at the post by last entrant Lithium Americas. Ganfeng, however, was not left empty handed – acquiring Bacanora Lithium and International Lithium during the year. The other Chinese player to participate in the M&A action was Zijin Mining – who picked up Neo Lithium in October. The Australian Piedmont Lithium acquisition of North American Lithium was also completed taking another step forward in the building of a production hub in Quebec.

2021 ended with Mining giant Rio Tinto pledging over $2 billion to develop its Jadar lithium mines in Serbia, but immediately facing backlash from protesters leading local authorities to momentarily suspend the land-use plan for the mine. Undaunted, Rio Tinto turned its head to the South American Lithium Triangle and bought the Rincon Mining Project in Argentina for $825m. A clear and definitive sign that the big miners are jumping into the Lithium sector.

Chile

In Chile, leftist Gabriel Boric won the presidential election. While campaigning, Boric expressed plans to form a state-owned lithium miner to manage the country’s “lithium triangle”, the world’s largest reserve. Industry experts doubt this is possible given the strength of the lithium companies in Chile. The change in leadership is also unlikely to affect the recently announced tender for exploration and production of lithium. It is believed over 50 companies have showed interest in the tender and both SQM and Albemarle have also announced intentions to expand their production. Chile is putting a flag in the ground to mark their intention to be No 1 lithium producer in the world again.

And where do lithium prices go from here? With LCE at an all-time high we are now in new territory. With a significant lithium deficit hanging over the market for the foreseeable future and demand only increasing it’s hard to see prices going down, so the question must be just how high will they go?

Lithium properties are being bought for production development at a rapid pace, but it can take up to 5 years for a project to go into production. So, these properties are not likely to having any impact on supply for 2-5 years. Market analysts expect to see prices rising again in 2021.

Uranium

Prices – a year in review

As the news gets ever more bullish for uranium the recent market sell-off saw uranium stocks fall victim to the loose hands of meme investors. These recent retail investors have added a complexion of volatility and their selling recently was in line with the sell-off in crypto, growth stocks and meme names. This selling is a function of the fact that they have either lost patience with posting rocket emojis on Twitter to a deaf audience or they have been margin-called elsewhere. The pressure on uranium stocks is exacerbated by the fact that the total value of global uranium stocks is $35.78bn. Strip out the two producers Kazatomprom (KAP) and Cameco (CCO) and it is $16.57bn. In 2007 the global market cap of uranium was over $150 bn! No one said uranium investing was easy, but it is crucial to constantly reassess the thesis, one which is only getting stronger.

This has been an amazing year for uranium, with equities up over 100%. Most of this move came from the actions of Sprott and other sequesters. The real move will come from the utilities themselves. Request for proposals (RFP) by utilities are now beginning to pick up. It is rumoured an Asian utility has issued an RFP with a ceiling price for 2025-30 of $78 lb, well above today’s price of $43 lb.

EU’s sustainable taxonomy

The first two parts of the EU Sustainable Taxonomy, the EU’s ambitious labelling system for green investment, was passed on 9th December and will come into force on 1st January 2022. It describes the sustainable criteria for renewable energy, car manufacturing, shipping, forestry, and bioenergy and more, and includes a “technology-neutral” benchmark at 100 grams of CO2 per kilowatt-hour for any investments in energy production.

Last night just before midnight nuclear, and gas became labelled under the taxonomy. This is a massive boon for uranium as it now counts as green sustainable investment. The construction of new nuclear plants will be recognised as green for permits granted until 2045.

Kazatomprom

Kazatomprom this year accounted for 41% of world uranium output. KAP’s asset base goes into decline in 2026 and production collapses after 2031. Although it has a portfolio of exploration assets the incentive price to mine those will be considerably more than the <$20 lb it currently costs. Recently KAP’s directors submitted to the Kazakh Ministry of Energy a proposal for a 25-year plan for development of Budenovskoye Blocks 6 and 7. It is also worth noting that production from 2024-2026 is fully committed for supplying the needs of the Russian civil nuclear energy industry.

Last month KAP announced its investment in ANU Energy, to hold physical uranium as a long-term investment, with its initial purchases financed through a founder’s round investment totalling US$50 million. The Fund could raise up to US$500 million to purchase additional uranium. ANU Energy will be the first fund providing emerging market investors, particularly those focused on ESG and clean energy, with direct access to a locally based physical uranium investment.

SMR build times and capacity

Over the last four decades, the average time it has taken to build a new nuclear power plant has ranged from 58 to 120 months. This is a long-term commitment, meaning that many countries simply idled capacity rather than tear it down even when the industry suffered image issues following Fukushima. There were 441 operable plants spread out across 30 countries as of 2021.

The advent of Small Modular Reactors is changing this. The Roll-Royce SMR targets a 500-day construction time on a 10 acres (4 ha) site. Overall build time is expected to be four years, two years for site preparation and two years for construction and commissioning. These SMRs will have power capacity of 470MW which can meet the energy needs of 1m people, enough to supply Sheffield and Leeds combined.

In 2017, the UK government provided funding of up to £56 million over three years to support SMR research and development. In 2019 the government committed a further £18 million to the development from its Industrial Strategy Challenge Fund. Last month the UK government provided funding of £210 million to further develop the design, partly matched by £195 million of investment by Rolls Royce. They expect the first unit will be completed in the early 2030s.

As spoken about before, the US signed a $1 trillion infrastructure package in November where $2.5 billion has been allocated towards the development of SMRs. The US is also set to construct a $4 billion power plant backed by Bill Gates and Warren Buffet in Wyoming.

China build & stockpile

China plans to become world’s biggest nuclear power generator, with 150 new reactors to be built in the next 15 years. Costing $440 billion, their plans would see the country build as many reactors in 15 years as have been created globally over 35 years. China have also announced that they plan to create a strategic uranium stockpile at a location on the border with Kazakhstan. The ‘Alashankou’ warehouse is expected to hold a whopping 23,00 tU storage capacity by 2026 (that amount is equal to the annual production in Kazakhstan).

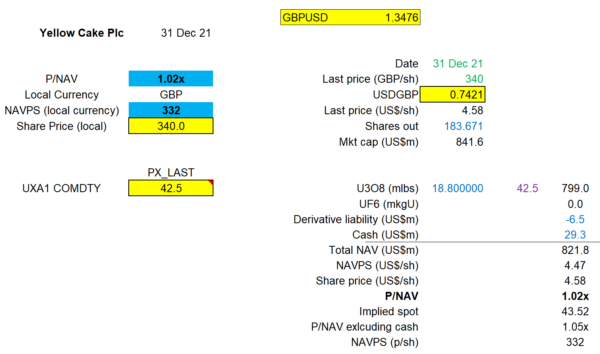

Yellow Cake

Having tightened from a 10% discount on 3rd December YCA is now on a 2% premium to NAV:

Event driven – a vintage year and same potential for 2022

Reflecting over 2021, we could consider it the year of the big rebound, with the COVID-19 vaccines driving a robust economic recovery and steadily improving markets; but as the year came to a close the emergence of the Omicron variant showed all asset classes that we haven’t beaten the virus yet. The world looks both different from a year ago and very much the same. Like this time last year when we looked at the investment opportunities unfolding in the event driven space, we recognise a more challenging landscape but very much the same potential for upside.

It would be hard to consider that M&A can top the past year. 2021 was the highest deal making year for four decades. There were more than $5.8tn deals which represents a 64% increase on 2020 and is 54% higher than in 2019 before the pandemic. Additionally, whilst discussing the M&A activity you can’t exclude the part SPACs had to play in the landscape, with interest rates at record lows, optimism about a strong economic bounce back from the COVID-19 crisis, and plentiful capital among investors. A total of 334 SPAC deals were announced for a combined US$597 bn. That compares to 256 SPAC IPOs worth US$84 billion over the whole of 2020. We believe the M&A momentum will continue into 2022. Many of the drivers underpinning recent dealmaking – PE’s $2.6tn dry powder, the digitalisation imperative and the weight of money in SPACs, for example – are not dissipating, in addition the economic backdrop remains supportive. The IMF’s forecast is for global output growth of 4.9% in 2022.

In the credit landscape the investment opportunities look to be a little more nuanced, expensive debt markets in the United States and Europe will be best navigated by experienced stock pickers that know how to single out companies and industries that are best positioned to navigate supply-chain disruptions and inflationary head winds. Virtually every corner of credit rallied in the past two years after central banks and governments stepped in to provide unprecedented support, but with the U.S Federal Reserve weighing the decision to remove pandemic support at a faster pace, the year ahead will reward experienced focused investors that are able to recognise which companies can stand on their own fundamentals as the support is withdrawn. Peter Faulkner Deputy CIO of PSAM with over 37 years in credit investing is not only equipped to navigate the divergence within credit that we expect for 2022, but the global reach of PSAM’s investment and research teams means PSAM are poised to be able to identify opportunities other credit investors will not see.

Peter will present his investment approach, outlook for 2022 and wider views on the event space to a small group of Ocean Wall invited investors on 25th January. To join this webinar please contact Clarissa at clarissa@oceanwall.com for details.

Plexo Capital Fund II – a VC model that values the unique perspectives of diverse investors

Set up by Lo Toney, ex-Google Ventures, Plexo Capital has become a leading voice for diversity and inclusion in VC.

Plexo believe that diversity is an unrealised source of differentiation in early-stage VCs that creates a powerful network effect. Plexo is an institutional investor allocating capital to the global start up ecosystem – investing as a LP into diverse-led GPs. By targeting Persons of Colour (POC), Underrepresent Minorities (URM) and Female GPs they have been able to generate superior returns by investing into the full stack of financing opportunities in the start-up ecosystem.

Lo has data that POCs leverage their networks, and evaluation lens, as an alpha strategy to source start-ups for direct investments. The by-product of this strategy is an increase in diversity across the start-up ecosystem.

Focusing on their investment thesis – Enterprise, Marketplace/eCommerce Infrastructure, Fintech, and Consumer – currently Plexo Capital have access to 1,300+ companies through their GP Network.

Their diversity stats are outstanding with 33% Female GPs, 73% Persons of Colour GPs, 17% Persons of Colour Female GPs, 53% Underrepresented minority GPs and 10% Underrepresented minority Females GPs.

Investors in Fund I include Google, Intel Capital, Ford Foundation, RBC and Cisco, amongst others, and it is already +60% in the last two years.

Plexo are now raising for Fund II and Ocean Wall is helping them in Europe. Contact nick@oceanwall.com for further information.

And finally, a big thank you to anyone who donated to Norah’s North Pole. The ‘presents for children’ fundraiser exceeded their goal and raised a fantastic £28,398. The charity was able to give more presents than ever this year and asked us to pass on their heartfelt thanks for all your generosity.