Welcome to August’s Some Thoughts. In this month’s edition we discuss:

- How 2021 is shaping up to be a good year for hedge funds as Event Driven leads the way but have the latest crackdowns in China left a mark?

- Since 2010 the S&P 500 has delivered a 379% return whilst the FTSE 100 has delivered only 69%. Why is this? Ahead of a new Ocean Wall report in September on UK ‘Sum of the Parts” trades we set the scene before we reveal our ‘hidden gems’.

- A company that has tapped into what dedicated ESG focused funds and investors are really looking for and can provide proper metrics to the ESG specialists at the major funds.

- The launch of Listed Lithium contracts on CME and LME.

Hedge fund trends & China flow

According to Morgan Stanley’s Q2 2021 investor survey, sentiment towards hedge funds is at decade highs. 2021 has been a good year for event funds with the average fund +12.78%. The number, globally, for all funds is 7.14% with macro and multi strat slightly lagging at 4.17% and 6.93% respectively. Equity and credit average returns are both on the average at 7%.

With regard to strategies, interest levels for Global Discretionary Macro and Credit Strategies have seen the largest decline QoQ. Interest for Equity L/S funds was stable whilst interest for Event Driven has increased strongly. As it relates to the usage of Sustainable and Responsible Investing (SRI) strategies, the % of allocators that currently use them across their overall portfolio notably increased YoY (to 38% in 2Q21 from 26% a year ago). This investing strategy continues to be more common amongst European investors (43%) vs. US investors (26%). When it comes to evaluating managers, it has become more important to investors that managers integrate an ESG framework as part of their investment process. Fee reductions are still a focus for investors with ~55% of investors that think there is further to go but this has seen a limited change due to strong hedge fund performance over the last couple of years. After 15 months of quarantines and lock-downs, investors are beginning to travel to see hedge fund managers again. That being said, some 36% investors are still reluctant.

The China discount is growing as a result of the latest crackdowns. International investors had net sales of $2bn in Chinese equities last Monday alone, according to the FT. While the average global hedge fund is down only ~50bps last week as Chinese equity indices have lagged (MSCI China Index -13.5%), China-focused L/S funds were down closer to ~2.7%. Hedge funds have sold Chinese equities, but the magnitude of the selling was smaller than many would have expected given the price action. According to MS most of the selling was concentrated in H-shares, whereas ADR flows have been more muted. Net exposure to China (particularly ADRs and H-shares) was already at a low entering into the month, which is perhaps why performance hasn’t been more challenging and why there hasn’t been active de-grossing amidst the recent underperformance.

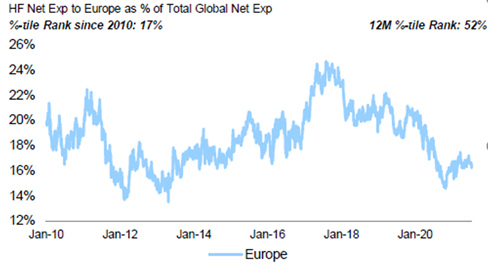

Flow wise, July has seen Europe the most net sold region with hedge fund net exposure in the region falling back toward 12-month median levels.

Hidden in plain sight

Over the past decade, UK equities have consistently underperformed other major developed markets in terms of total shareholder returns; between 2010 and 1H 2021, S&P 500 delivered 379% return, DAX delivered 111% whilst the FTSE 100 delivered only 69% (and only 9% excluding dividends) in dollar terms.

These differences can be attributed partially to structural and fundamental factors. FTSE 100 has a greater leaning towards value and traditional sectors with less growth vs new economy sectors such as technology and healthcare which heavily weight the S&P 500. In addition, in this dovish central bank environment, markets have consistently favoured growth over value.

The UK has also had to contend with the pressures of Brexit and has seen a sluggish recovery post-Covid – mainly due to its high exposure to physical business models.

Currently, the S&P 500 trades at a 2022 P/E multiple of c. 20.5x vs FTSE100 2022 P/E of c.12.6x and FTSE250 2022 P/E of c. 16.0x. And whilst the bear argument and structural issues do exist for many UK companies – there are many ‘hidden gems’, or ‘gem components’ of those larger UK companies, that should be worth on par – and in some cases, more – than their US or global counterparts. Often these valuable parts can be lost or overlooked when valued together with other parts of a business at a conglomerate multiple.

With some hedge funds and investors (Elliott’s stake in GSK, Altice’s stake in BT and Cevian’s interest in Aviva) moving towards the UK market, we believe that now is a good time to look again at some SoTP opportunities.

In September’s Some Thoughts we will focus on five ‘hidden gems’, that illustrate why we believe there is still real value to be had in the UK market.

ESG – Investor and Fund focus

Although nothing new, it was interesting that the MS investor survey said how important it was that managers integrate an ESG framework as part of their investment process. With more and more focus being placed on company ESG credentials and a lack of distinct rating criteria and agency – we have been increasingly impressed by the work that Investor Update is doing in this space. With a long-standing history of fund and investor relations, they have tapped into that knowledge base to find out what dedicated ESG focused funds and investors are really looking for – as well as talking to the ESG specialists at the major funds.

Working with public companies they then do an analysis of their shareholder base versus their European peer group to see if they are attracting ESG funds and who is ‘missing’ from their register – and rate them accordingly. With Investor Update using their in-depth investor knowledge they can demonstrate what the company’s peer group is doing but also what part of the ESG investor free float might be available to invest in them if they can address or change their ESG policies and narrative. Investor Update – Market Intelligence.

Lithium – commodity trading

In May 2021, CME Group (US Metal Exchange) launched Lithium Hydroxide futures – the first time that this highly sought-after battery metal had been traded on such an exchange. Alongside their recently launched Cobalt Metal futures – the exchange was first to establish a forward curve for two key materials in the green economy.

Not wanting to be outdone, the London Metal Exchange, launched on 19th July, their new lithium hydroxide future – a product that is 3 years in the making and a clear response to the booming demand on lithium supplies. They, too, already have a cobalt future trading on their exchange.

Initially, the LME faced stiff criticism from the lithium mining community who had concerns about how a futures contract could standardise a product that is produced in such varying qualities and grades but with a committee of lithium giants (Albemarle and Tianqi Lithium) behind it – they have created a product that is being well received.

These lithium contracts will satisfy two market segments; key manufacturing market participants, such as the automotive, battery and mobile communications sectors, now have more tools to manage their forward pricing risks, whilst the growing interest from investors seeking exposure to the green economy can also participate.

With demand for lithium set to grow sevenfold by 2030 as sales of EVs increase (according to Benchmark Minerals Intelligence) and prices in lithium hydroxide up by 86% this year. For more details on our lithium thesis see our Case on Lithium Report.