The situation since the last Some Thoughts has changed materially. The UK & US are now beyond the peak from early January. Both countries are on pace to vaccinate 75% of their population against Covid-19 this year. One can start to feel increasingly optimistic about how it plays out.

At one end, you have technology advances gathering pace as vaccine efficacy is so far ahead of expectations. At the other end, though, we are seeing new variants, though vaccines look like they will be effective against these and they were entirely to be expected. In the main, governments have learnt the lessons from 2020 and are listening to scientists much more closely.

According to a large US prime broker a basket of their most shorted stocks was +98% in the last three months. The heady cocktail of high saving rates, direct cheques, free brokerage, social media, excess free time, an investment-as-a-game mentality, margin account leverage, financially literate leaders, ‘free’ trading and Marxist ruling class anger conspired to create something that quickly dismantled conventional wisdom about ‘dumb’ retail. Though this movement may dissipate in the immediate term, for the moment it has changed the parameters of short selling.

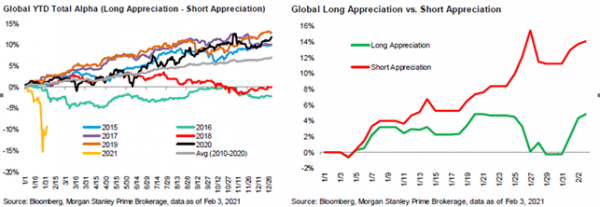

In terms of de-grossing and performance degradation the last week of January was the largest one for over a decade with each day setting new records. Equity L/S funds accounted for ~85% of the total de-grossing and this led to the largest day of de-grossing for the strategy since 2010.

The average global fund ended January down ~70bps and the average US L/S fund was down -2.3%, but all strategies have been able to post gains thus far in Feb, led by US L/S funds who are up +2.9%.

Despite the recent recovery, total alpha is still off to its worst start in a decade at -9.3%.

It is worth remembering the bull factors for this market. Authorities’ global antidote to Covid-19 has been a $14tn global fiscal response. We have had an increase $4trn M2 money supply in US pre-Biden’s stimulus. 19% of all US financial assets now sit in cash. Within Private Equity there is $1.9tn of dry powder available. Debt markets continue to be supportive in terms of both leverage and cost of financing.

Covid-19 has thrown up lots of interesting valuations. There is more optionality for bids, counterbids, stressed debt, bankruptcies, liquidations, and insolvencies; and special situations such as splits, buybacks, litigation, sum of the parts trades or other significant transformational corporate events. This is what we concentrate on at Ocean Wall.

In this month’s, Some Thoughts we review a private raise that completed in the week for the most exciting precious metal on the planet. Alongside Peter Faulkner, co-CIO of PSAM, we will walk through the theme of event driven corporate distressed opportunities in companies limping through the economy unable to dig themselves out of their debt obligations. Our Future of Work presentation last Thursday was a tour de force from Doug Atkin (ex-CEO Instinet), Duncan Niederauer (ex-CEO NYSE) and Douglas Atkin (ex-Global Head of Community at Airbnb) – see our Ocean Wall meets sessions which includes a follow-up

Q&A session with Doug Atkin Lastly, we look at an angel round for a UK SME cloud migration company already working with both AWS and Azure.

Expressing the Lithium thesis – Private Placement in Lithium Chile

With lithium carbonate prices having the strongest start to the year since 2015 (pricing up 37% to US$11,175/t in China – up from US$6,000-8000/t range) and with lithium analysis experts, Benchmark Mineral Intelligence, forecasting that by 2025, lithium demand will outstrip supply by nearly 228,000 tonnes, it is no wonder lithium companies are seeking to accelerate their drilling plans.

Ocean Wall has always had a particular interest and focus on the smaller Canadian listed lithium exploration companies and on Monday 25th January, we saw Alpha Lithium (ALLI) a TSX-listed Canadian mining company with one Argentine lithium property raise C$20m via short form prospectus at C$0.81 per unit (one share + one warrant). The deal was originally meant to be C$10m but was >3x oversubscribed. The share promptly rallied to C$1.10. There have also been raises this week from the larger UK and European listed Lithium Producers – including Vulcan and Bacanora – all fully subscribed and well received.

Ocean Wall favourite, Lithium Chile, has greater acreage (71,900 vs 27,500 hectares), will have lower productions costs ($1,800/t vs $3,000/t) and far higher lithium concentrations than ALLI (up to 1410 mg/l vs 504 mg/l), and in fact, based on ALLI’s valuation per hectare Lithium Chile has a look through valuation of C$1.81 per share.

Rather than a public placing LITH decided to do another private raise to accelerate their drilling program on their Top 4 properties. They priced the offer at C$0.28 per unit (a 10% discount on the closing price from the night before). Each unit consisted of one share and one warrant – strike price C$0.60 – exercisable over 24 months.

Lithium Chile’s share price climbed during the week eventually closing +43% at C$0.40 from the unit placing price.

Please get in touch if you would like more information on Lithium Chile or click here for an opportunity to hear the Ocean Wall Q&A with Steve Cochrane.

Introducing Ocean Wall meets ……….

Ocean Wall will be running an ongoing interview series with key business leaders. Presentation and Q&A sessions run by Nicky Grant – Head of Corporate Advisory. All recordings are available to view at OWL Meets

Credit Landscape

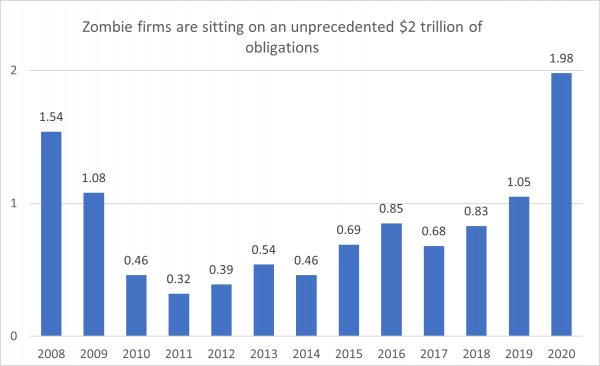

In a time where uncertainty seems to be a central theme rather than a passing trend and although we are structurally bullish of global growth the outlook for the credit market has particularly drawn our interest. After a record-breaking year of issuance in 2020 with companies raising $2.5tn in bonds in the US alone, we believe there are some exciting opportunities to be found in the evolving corporate debt landscape.2020 ended with the highest number of bankruptcies recorded since 2011, and for the companies that survived/avoided this fate loading up on debt was the only route possible. The environment of easily available credit, and a combination of new financial support and business protection measures may have saved these companies from bankruptcy, but what they have evolved into is something very different. More than 200 companies have become so-called “zombie companies”, categorised as a business limping through the economy burdened by their debts and unable to earn enough to pay off their interest. The “Corporate undead” are populated with titans of industry, Boeing, Carnival, Delta Air and Rolls Royce and what is more staggering than the calibre of companies with such status, is the below graph that shows the added $1trn of debt that they added over the pandemic. The question is what is the fate of these companies? When the debt holders want their money back, and the corporate relief programs end, which companies will manage to grow out of their debt and restructure to stronger more resilient businesses, and which companies will downgrade further and become fallen angels?

Source: Bloomberg Dec 2020

The path to recovery will not be an easy one, and we feel it is important to look to experienced and nimble specialists to navigate the economy that we find ourselves in.Here at Ocean Wall, we are looking forward to hearing from Peter Faulkner Deputy CIO of PSAM in our Family Office Event at the end of the month, where he will be exploring event driven corporate distressed opportunities amongst the landscape of zombie companies. Details immediately below.

The Corporate Undead – Peter Faulkner of PSAM

Date: Wednesday 24th February at 2pm GMT

Ocean Wall welcomes Peter Faulkner Co-PM of Credit and Deputy CIO of P. Schoenfeld Asset Management (PSAM). Many companies may find themselves with too much debt after the coronavirus pandemic, even if their businesses recover. The default rate will climb as companies struggle to regain profitability, covenant relief periods expire, and ratings agencies downgrade given earnings and liquidity constraints. Peter will discuss the theme of event driven corporate distressed opportunities in companies limping through the economy unable to dig themselves out of their debt obligations.

Please email ng@oceanwall.com for Zoom Details.

Junkshon – Cloud Migration Experts

Ocean Wall are also pleased to invite you to a presentation from Martin Southgate, CEO of Junkshon. They are a cutting-edge SaaS business working very closely with the major Cloud Service Providers, including AWS and Azure, to coordinate the migration of their major customers on to the cloud in a super-efficient manner.The past year has accelerated this migration exponentially and Junkshon are poised to benefit enormously from this. Martin will outline the business, their future growth and where they see the future of cloud computing. Cloud services are undoubtedly the major beneficiary of the change in corporate working practises over the last year and Junkshon are riding that wave.Martin Southgate CEO will be presenting on Thursday 25th February at 5pm GMT. This is a rare opportunity to invest at a very early stage in a very high growth SaaS business. Please contact ian@oceanwall.com for further information or if you wish to join this call.

what3words

Founded in 2013, what3words essentially points to a very specific location. Its developers divided the world into 57 trillion squares, each measuring 3m by 3m (10ft by 10ft) and each having a unique, randomly assigned three-word address. what3words’s mission is to make their system the universal standard for communicating location, and to ingrain 3 word addresses into consumer behaviour and become the de-facto standard. Already eagerly being adopted by the car industry – clients include Daimler Benz, Ford and Toyota – it is now the turn of the delivery companies to realise the enormous time and cost savings, estimated at 15% by DPW, which come with an accurate address – with MyHermes, DHL. Royal Mail and Deutsche Post jumping on the bandwagon. Here the Financial Times article today sets out why we need a new system and the benefits the precise accurate location app is bringing to the world. FT – 6th February – what3words