Welcome to June 2022’s Some Thoughts – A Hedge Fund Special

Although geopolitical events are impacting performance, the resulting market volatility is now favouring hedge funds. In terms of markets, we are seeing a shift from US high growth/no profit companies towards a genuine opportunity for alpha. Increasing volatility is presenting opportunity sets for active managers that have not existed since the start of central bank balance sheet expansion ten years ago.

The next two years will likely see a shift from passive funds to actively managed funds – alpha will eclipse beta.

Ocean Wall are grateful to Morgan Stanley for an invitation to their 23rd European Hedge Fund Forum in Barcelona last week. I have attended this conference many times over the years, and this was the busiest I have seen it with over 500 hedge fund and investor attendees.

In this month’s Some Thoughts:

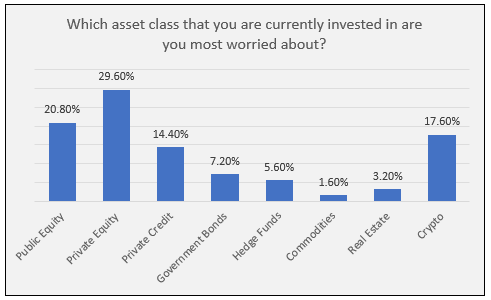

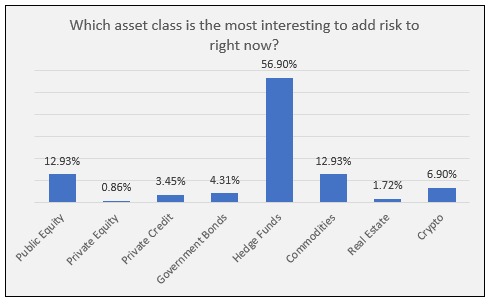

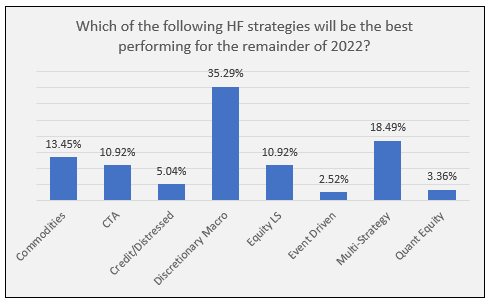

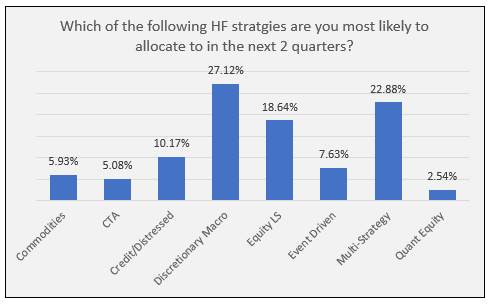

- We review the Barcelona conference. Despite the market backdrop the mood was upbeat as, of the 270 allocators present, over 65% are looking to increase their allocation to hedge funds for the rest of 2022. Morgan Stanley set up electronic voting throughout the conference for allocators and below we show the most interesting results.

- One of the most engaging panels in Barcelona was “2022 Opportunities in Event Driven Investing” that featured PSAM, Oceanwood, Palliser and Luxor Capital. With central bank policy divergence, we will return to a normalisation of higher volatility and lower correlation. This will offer significant opportunities for Event Driven investing. We look at the most favoured strategies, best opportunities and biggest worries.

- Ocean Wall’s Head of Investments, Clarissa Watkins, has spent the last six weeks road-showing in Europe and she shares her views from inside the offices of the hedge fund allocators.

Hedge Fund performance/The Investor Polls on Hedge Fund Allocation

In Citco’s report it is expected that there will be close to $20 billion of investor redemptions for the rest of 2022, even after seeing a net inflow in the first quarter. These numbers are smaller than the first-quarter redemptions of almost $39 billion. The majority of these redemptions will be centred around the large tech-heavy funds that have suffered outsize losses. Getting the strategy right now is crucial as only 40% of hedge funds globally made money in the first quarter, compared with 61% in the previous three months. The return gap between the top and bottom 10% performers widened to nearly 26 percentage points in the first quarter, from 17 percentage points three months earlier, the report showed.

It was clear from the polling results below at the MS conference that the hedge fund industry is gearing up for potential fresh investments in Europe. Citco also noted the industry drew a net inflow of $13.6 billion in the first quarter, more than double the amount in the previous three months as fresh subscriptions reached $52.5 billion, overwhelming redemptions. There have also been significant actions from large US pension funds. Oregon PERF and Iowa PERS have over $1bn each of new commitments to hedge funds. Florida SBA, Pennsylvania PSERS, Sacramento County ERS, TRS Texas, Mass PRIM and Kern County ERA are all allocating more to hedge funds.

An Eventful Year – 2022 Opportunities in Event Driven Investing

The macro set up for 2022 was the continuation of the impact of Covid on European companies still facing a revenue shock and having been forced to aggressively restructure to survive. The invasion of Ukraine has brought different challenges around supply chain logistics and inflationary concerns. This confluence of factors coupled with the Fed tightening means a significant variance of performance between winners and losers. European value investing is always at a disadvantage to the US due to its mechanical structure. The US drives securities prices in Europe and passive/ETF investing has added to that. Often this market noise is irrelevant to the companies but is a genuine risk to share price performance. The return to value may remove that negative dependency on the US to some extent.

Already we have seen a psychological shift for investors in that it is now all about the price one pays for the asset rather than the asset itself. Discipline around sales and EBIT multiples, previously ignored by recent tech valuations, will become investor yardsticks again. The framework with be based around a higher cost of capital while businesses that flourished under cheap capital will be tested and will provide further opportunity on the short side. In a harder asset raising environment the primary market will be led by rights issues rather than IPOs.

Event managers will now have opportunities to put money to work as the variance between long and shorts is going to be extraordinarily strong so:

Where are the best opportunities?

Questions will continue to be asked of the, now out of favour, growth stocks as to whether their models work in a higher rate environment? Is the science correct? What is their need for cash? Can they dial back expenses?

In previous inflationary environments it is commodities that performed best but also European stocks with a value bias and pricing power. Counter that by being short the bonds of consumer discretionary companies where incomes are based around households that have $50-100k incomes pa.

Already companies are looking at their supply chain and substituting expensive inputs. Winners will be cash flow resilient, able to make substitutions and change their behaviour. Herd FOMO has already disappeared, and management teams will be punished disproportionately if investor enthusiasm for their business plan begins to wane.

Event managers have already seen short duration M&A spreads widened by c. 100bp and medium duration widened by 150bp. Against a weak market and negative headlines managers will be more discerning. Rather than rush in and crowd trades on a deal announcement the best will sit on the side-lines waiting for an upset and the subsequent forced selling before they set up the trade.

Because there is currently $4tn of high yield debt outstanding globally so interest rate sensitivity will be a key factor. This will lend itself to managers who use credit protection as an overlay hedge. Shorter duration deals will be more defensive in this landscape.

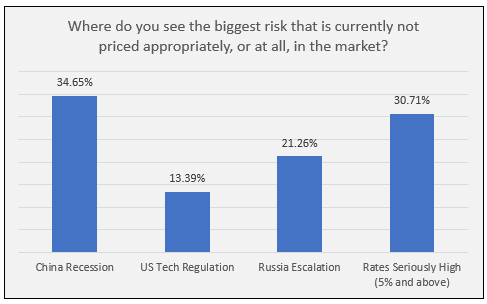

Naturally everyone at the conference was concerned about the corrosive nature of inflation and the inevitable demand destruction as well as the escalation of war, but the biggest risk perceived as being inappropriately priced by the market was a China recession ahead, even, of >5% rates.

Also mentioned as a worry to investors yet to be fully appreciated was the human effects after Covid. One of the reasons for the labour shortage is people choosing not to be available as well as a de-skilling.

Clarissa Watkins reviews meetings across Europe : Diversification

2022 is continuing to be a particularly challenging year for the markets, and at this time where traditional assets are subject to rising inflation and currency cycle change, the topic of alternative strategies has become increasingly important. Over the past three weeks travelling and speaking with investors across the UK, Switzerland, Greece, Italy, Andorra, and Spain I have had the privilege to hear multiple people’s views on the markets, Russia/Ukraine war, post-pandemic life, crypto investing, rising inflation, and much more. Whilst there were many differing opinions and a divergence of views on the topics, a key word kept coming up. Diversification.

Speaking with two separate Heads of Liquid Alternatives yields an insight into the increasing importance of alternatives. Both conveyed the increase in demand for their time and their recommendations, not just from the dedicated Alternative Fund of Funds teams, but their colleagues in Multi Assets portfolio management and private banking who are beginning to urge clients to diversify their investments. The Head of Alternatives for one of the largest Italian Asset Managers shared that several clients that cut all exposure to alternatives after the GFC have become receptive to start an allocation to liquid alternatives.

This sentiment was echoed in a conversation with a large UK based consultant who believes the evergreen 60/40 structure that served investors well for decades, needs to be adjusted for the current and future economic conditions. He shared that the 40% in bonds was the problem, and what they are proposing to clients is a 60/30/10 model with 10% to be allocated to alternative, diversified and niche strategies with higher expected returns.

Further exploration of the topic led to more shared views on where in the wide spectrum of strategies amongst the liquid alternatives space people should be focusing. Allocators across the UK and Europe all expressed a focus on CTA, Global Macro and Event Driven strategies. The feeling is that managers in these areas are better positioned and skilled to navigate the volatile and uncertain environment.

Another telling sign that should not be overlooked is the sharp increase and demand for new hires in the alternatives space. Teams that have remained stagnant for years, and in some places disappeared altogether are now on the hunt for new talent. Two Swiss based family offices that have been using consultants and external asset managers since the GFC to source their alternative investment ideas have made the decision to bring talent and decision-making back in-house to drive a more meaningful allocation to alternatives. Whether it’s new blood joining a current team, or companies re-establishing an alternatives department, the signals all show the route to diversification for many is alternatives.

A global platform that hosts over 100,000 funds from 2,000 fund houses also reported a surge of requests and searches for funds classified as “Alternative UCITS”. Diving deeper into this trend showed it wasn’t just current investors making the decision to increase their alts allocation, but clients that had been solely focused on traditional assets were rotating out of their current positions and diversifying their portfolios.

2022 has been a humbling experience even for the most convicted investors, and with so many questions around the Russia/Ukraine war, energy security, supply chains disruption and inflationary pressures what we can be sure of is 2022 still has further tests ahead. Whether it’s a Swiss Asset Manager, a Greek family office, an Italian Fund of Funds, or a UK consultant, the tool to navigate the time ahead is diversification.

This email is intended solely for the addressee(s) and may be legally privileged and/or confidential. If received in error please delete it and all copies of it from your system, destroy any hard copies of it and contact the sender. Any unauthorised use or disclosure may be unlawful. The accuracy or completeness of this email is not guaranteed. Any opinion expressed in this email may not necessarily reflect the opinions of Ocean Wall Limited. Any personal information contained in this e-mail is provided solely for the purpose stated in the message. All emails may be monitored in accordance with legal requirements contained in Regulation of Investigatory Powers Act, Data Protection Act, Telecommunications Regulations Act and Human Rights Act.

This email is not an offer or a solicitation to buy or sell any security. It should not be so construed, nor should it or any part of it form the basis of, or be relied on in connection with, any contract or commitment whatsoever. It is not an advertisement to an unlimited group of persons of securities, or related financial instruments. The email does not constitute a personal recommendation and the investments referred to may not be suitable for the specific investment objectives, financial situation or individual needs of recipients and should not be relied upon in substitution for the exercise of independent judgement. Past performance is not necessarily a guide to future performance and an investor may not get back the amount originally invested. The stated price of any securities mentioned herein is not a representation that any transaction can be effected at this price. Ocean Wall Limited, or its respective directors, officers, employees, and clients may have or take positions in the securities or entities mentioned in this document.

Each email has been prepared using sources believed to be reliable, however these sources have not been independently verified and we do not represent it is accurate or complete. Neither Ocean Wall Limited, nor any of its partners, members, employees or any affiliated company accepts liability for any loss arising from the use of the Report or its contents. It is provided for informational purposes only and does not constitute an offer to sell or a solicitation to buy any security or other financial instrument. Ocean Wall Limited accepts no fiduciary duties to the reader of this email and in communicating it Ocean Wall Limited is not acting in a fiduciary capacity. While Ocean Wall Limited endeavours to update on a reasonable basis the information and opinions contained herein, there may be regulatory, compliance or other reasons that prevent us from doing so. The opinions, forecasts, assumptions, estimates, derived valuations and target price(s) contained in this material are as of the date indicated and are subject to change at any time without prior notice.

The views expressed and attributed to the research analyst or analysts in the email accurately reflect their personal opinion(s) about the subject securities and issuers and/or other subject matter as appropriate. Information that is non-factual, interpretive, assumed or based on the analyst’s opinion shall not be interpreted as facts and where there is any doubt as to reliability of a particular source, this is indicated.