Welcome to May 2022’s Some Thoughts. This month we discuss:

- A world returning to commodity-backed money

- Cleantech Investment: Direct Lithium Extraction (“DLE”) could be the key to bringing lithium into production more quickly than conventional methods.

- Arc: the award-winning electric motorbike manufacturer poised to launch Vector.

- Uranium enrichment: why enrichment is needed in nuclear energy and who the key players are.

- Geo-location company what3words has had a raft of new partnerships year to date – we review their new business take up and look at their Series D raise.

- Ocean Wall Events: Psychedelic Sector: Doug Drysdale, CEO of Cybin talks with Nicky Grant of Ocean Wall about the opportunities in the psychedelic space and why the recent price weakness has led to selective opportunities for investment.

On 26th July 2012 when Mario Draghi gave his famous “whatever it takes” speech he implicitly promised to backstop peripheral debt with the ECB’s unlimited balance sheet. As a result, the European crisis entered its final chapter. Fundamentally the solution was straightforward – money and lots of it.

Today Europe finds itself in an almost mirror-image predicament. This time the focus is less on the periphery, and more on Germany’s huge Russian gas bill. And the crucial difference is that no amount of money can easily solve the problem. There’s no way to restructure the country’s energy portfolio overnight. It’s a huge engineering challenge.

According to recent work from the interest rate strategy group at Credit Suisse there is no monetary solution to the problem. We share CS’s thesis that the world is going to go back to commodity-backed money. The new price measures to watch are actual goods and services, foreign cargo, shipping and protection. These are the new key price measures to watch for anyone wanting to get a handle on the future direction of the economy. Short-term interest rate traders, for instance, will need to know about shipping if they want to figure out whether liquidity is increasing or diminishing.

In the world of physical commodities your balance sheet is basically a ship. You load cargo in Port A, you bring it to Port B. The cargo is not money. The cargo is a commodity but is encumbered by the ship’s capacity to move stuff around. In this new framework, instead of the central banks guaranteeing that your money in the bank is good it will be the world’s militaries that guarantee that your cargo on the ship will actually get to its destination as advertised.

68 days into this war and we are 68 days into figuring out how basically all these things that we used to do very efficiently are going to be done in the future such as the re-routing of ships and the boycotting of commodities from here and giving it to there. A world with more commodity volatility and uncertainty is a world of more strain on financial balance sheets, as the financing of various operations such as mining, shipping, purchasing etc. becomes more costly and riskier.

Because Russia will want to sell gas in rubles and Saudi Arabia may want to start selling oil to China in yuan there will be greater monetary diversity, with different trade routes denominated differently. At the World Nuclear Fuels Conference last week, I asked the Head of Transport at Orano, the multinational nuclear fuel cycle company, by what percentage amount the transport costs of shipping uranium away from Russia has gone up by since the invasion – she said it was an exponential number! The main consequence will be that countries will become more inclined to stockpile commodities.

A crisis is unfolding. A crisis of commodities. Commodities are collateral, and collateral is money.

Cleantech – DLE – investment opportunities and accelerated cash raisings to meet the demand for lithium

Direct Lithium Extraction (“DLE”) is moving front and centre for the lithium battery industry. With most new resources taking up to 7 years to go from ‘confirmed’ resource to production; there is a desperate demand from the battery and EV industries for this timetable to be accelerated.

Currently a brine resource will be concentrated through a series of large evaporation ponds covering huge areas and hugely weather dependent – this process takes literally years to complete. Not only are these significant timing issues but it also requires huge amounts of water which causes environmental issues to the area – particularly affecting any local community that lives near the resource. This is a particularly contentious issue with the indigenous communities in Chile.

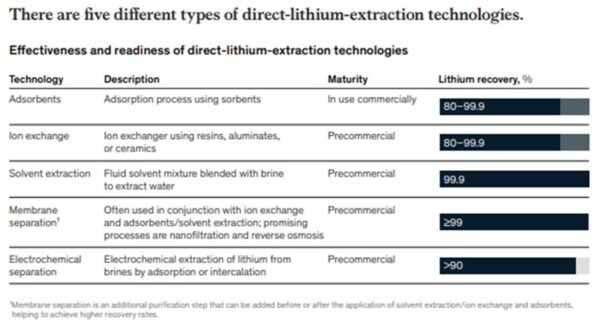

Promising DLE technology is currently being considered not only by specific scientific start-ups but also by main lithium producing companies. While their ideas differ, the concept remains the same: brine flows through a lithium-bonding material using adsorption, ion-exchange, membrane-separation, or solvent-extraction processes, followed by a finishing solution to obtain lithium carbonate or lithium hydroxide. Therefore, DLE will allow a company to pump, on-site, the brine containing lithium straight from source into the DLE plant, which in turn, through several different absorption processes, will output a considerably higher yield (around 80% compared to 45%) of lithium than would normally be obtained. All in a matter of days.

McKinsey & Co

A basic form of DLE has been used commercially since 1998 at Livent’s Hombre Muerto facility in Argentina – but in order to improve and develop the system Livent, itself, invested in E3 Metals Corp in 2019. However, industry veterans claim that E3’s system has been known about by the big production companies for years and is unsophisticated and will struggle to be scaled up.

The race to be ‘THE’ DLE system which started quietly for decades and is now, thanks to the whip of recent investment, galloping toward the finish line.

The Bill Gates-backed Lilac Solutions is probably the highest profile of all the DLE companies recently raising US$150m from investors – including BMW’s AG Venture Fund, Sumitomo, Lowercarbon Capital and T Rowe Price. They also just announced a partnership with Ford Motor Co to supply lithium.

Another of these high-profile innovators is Standard Lithium who also raised $100m recently from Koch Industries. There have, however, been several recent reports that their pilot process has been disappointing, although the company deny this.

In Europe, Vulcan Energy Resources raised almost $300m for their geothermal brine project in Germany; a huge gamble on DLE technology as geothermal lithium has never been commercially extracted before and, likely, only be extracted if DLE is successful.

At the beginning of 2022, there were already over 60 companies focused on DLE. Some of those on the fringes have already fallen away. We believe that the key ingredients to be looking for in a successful DLE company are: (1) The Scientific and Leadership team – without the right scientific innovators on board there is little chance of successful development, (2) Resource requirements – what level of energy, water or other infrastructure will be required, (3) Technology focus – what is the driving focus – high grade recovery? working at altitude? less water consumption? (4) Ability to deal with contaminants.

Slightly sitting under the radar is Summit Nanotech, a private, scientific led, company that has been an Ocean Wall focus for nearly 18 months. Under the leadership of geophysicist Amanda Hall, this company has been guided by a strong and uncompromising scientific integrity from day one. Such is their level of respect within the industry, that at the end of 2021, the Chilean Government ran an opportunity to pitch for a Cleantech funding award and despite the consortium, that Summit Nanotech were part of, not winning the funding, the Chilean Government still reached out to them to be involved. The company announced recently that they would be launching Series B shortly. For more information contact Nicky – ng@oceanwall.com

Award Winning Electric Motorbikes

Those of you with good memories will remember us mentioning Arc Vehicles back in December 2020. These super sleek electric motorbikes are at the pinnacle of cutting edge design and technology and recently won the coveted Motorcycle of the Year at the GQ eCar Awards.

Arc Vehicles are set to deliver the first Arc Vector bikes in mid-2022 and these extremely limited-edition motorbikes are set to become the high-end sought-after motorbike brand. Sleek, environmentally savvy and with an extraordinary design team behind them, they are reinventing what a motorcycle is. The team behind Vector have extensive car and motorcycle engineering experience – as well as EV expertise. Think of them as the Rimac of the motorbike world.

EVs are a rapidly growing market and the Vector is already in the end stages of development. Significant investment has already been deployed and with strong credible management and a scalable business plan Arc Vehicles is perfectly placed to take advantage of this sector opportunity. They also have highly sought-after technology that will be incredibly valuable to any motorbike manufacturers looking to move into the EV world. “In the background we have been working with a number of two, three and four-wheeled vehicle manufacturers to help them develop their EV propositions through the Arc technology we have created,” Founder Mark Truman confirmed.

For more information and to reserve your Vector go to www.arcvehicle.com. Jaguar LandRover are already an investor and there is an opportunity now to invest in a CLN alongside them. If you are interested in getting more information, please email Ian Ross on ian@oceanwall.com.

Uranium Enrichment – de-risking your uranium portfolio from the spot price

We were invited to attend the World Nuclear Fuel Conference in London this week. We have curated some notes which outline the key themes discussed. In general, the conference painted a concerning picture for US utilities whose inventories are depleting, as well significant rises in costs throughout the nuclear fuel cycle. Moving uranium around Russia will mean higher costs but also delays in supply. The enrichment cycle is a very precise one and, as global supply chains face disruption, delays will undoubtedly lead to rising uranium prices.

Please see our notes from the conference here.

Uranium is proving once again why it has, historically, been one of the most volatile assets an investor can own. Pullbacks in the commodities sector are inevitable, as commodity price inflation reduces discretionary income, and the central bank raises rates, understanding that we need to ‘keep the lights on’, is as simple an argument as one needs to see the direction commodity prices are headed.

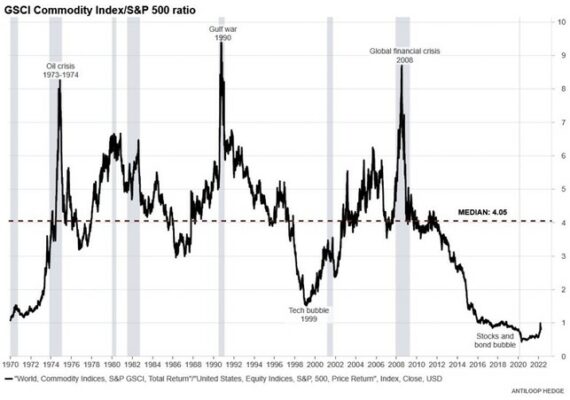

During times like this, it is important to remind ourselves that we are still in the early innings of a commodity super cycle. See below the GCSI commodity index/S&P 500 ratio for some reference as to the current dislocation between commodity and equity assets:

The recent uranium sell-off highlights the need to maintain a diversified portfolio not just outside of the uranium and commodities sector but also within. While producers, developers, and exploration companies trade to a varying extent in-line to the spot price, there are picks and shovels plays to de-risk investors’ portfolios away from future spot price volatility.

Enrichment companies offer such an alternative and differ significantly from both a financial and technological perspective.

Current operational enrichment services are controlled by state-owned companies; these include TENEX, Orano, Urenco, CNNC. All these companies have significant financial backing from their respective governments, a risk we highlighted for Silex in our report.

The US previously had enrichment capacity through state-owned United States Enrichment Corporation (USEC), this was privatised through IPO in 1998, and in December 2013, USEC announced that it had reached an agreement with a majority of its debt holders to file a prearranged and voluntary Chapter 11 bankruptcy. In September 2014, the company re-emerged as Centrus Energy Corporation.

We investigated Centrus to assess its viability as a potential solution to US uranium enrichment capacity (the US currently has no domestic enrichment capacity). We concluded that given Centrus’ reliance on Russia’s TENEX for its low-enriched uranium (LEU), the company currently presents too much risk. Centrus’ only IP is essentially its location. It enriches no uranium and simply acts as a broker to foreign suppliers who are exempt from selling directly to US utilities. In addition, its contract with the DOE for HALEU production runs out in June and the operational segment will not be actioned. The DOE has now changed the scope of this contract to be a new, competitively awarded contract.

From a technological perspective, innovation in uranium enrichment has stagnated for decades. Current centrifuge enrichment technology is ripe for disruption, and Silex Systems are pioneering advancements in this area using their proprietary Separation of Isotopes by Laser Excitation (SILEX) technology.

We have continually highlighted that uranium enrichment is considerably overlooked. With investors more focused on miners, we also understand that there is no use in having warehouses full of yellowcake that cannot be enriched domestically, the case for all but four nations globally.

Russian dominance in enrichment will not be countered overnight, but we think it is likely that as capital floods into ESG funds who are increasingly focused on nuclear power, enrichment companies will come to the surface as major picks and shovels plays within the wider sector.

Fission 3.0: In other news, Fission 3.0 announced on Monday that it had intersected an encouraging clay altered fault zone at the Heart Bay project in the Athabasca Basin. Uranium is often found in proximity to clay-altered and conductive fault zones. Fission 3.0 continues its drilling projects, and these encouraging signs support future drilling to discover uranium materials. See press release here.

Should you require more information please contact ben@oceanwall.com

What3words – high profile news and Series D terms

With active marketing campaigns running in the UK, Germany and India, following hot on the heels of the Christmas campaigns in Korea and Japan, subscriber numbers have escalated sharply.

What3words started the year with an announcement of a $10 million investment from Brand Capital International to support w3w’s expansion across India.

Other key news from 2022 …

- DPD UK adopts w3w for parcel deliveries – DPD video launch

- DHL Parcel UK adopts w3w for deliveries.

- Volta Commercial Electric Trucks and VinFast EV cars to have w3w integrated as their navigation system.

- Subaru of America became the 10th OEM partner that support w3w in their navigation system.

- Lamborghini will include w3w as standard on its new Huracan Models.

- UK Councils asking fly tipping to be reported using w3w.

- Openreach announced a 50% reduction in response time as a result of using w3w.

- Other UK announced adoptions: London Youth Rowing, Perfect Stays, Cereals Events, Purely Shutters, a load of event venues, event organisers, ticket companies, etc

- Sports: The Jockey Club adopted w3w for the Cheltenham Festival and The Oval – Surrey Cricket Club’s Ground and Twickenham Rugby have also started using w3w for fans and deliveries!

- Ricky Gervais, CALM and Netflix have now released a full list of their Benches of Hope – inspired by After Life – using w3w to pinpoint the exact location of each bench.

- RNIB actively pushing for events, businesses and venues to start using w3w to give blind people a more accurate address – a huge improvement in accessibility for the blind if w3w is used.

- USA: First US sports team – Orange County Soccer Club.

- Australia: Direct Couriers now using w3w.

- France: Fire brigade now can use w3w through Geoloc Systems.

And finally, to encourage smaller traders to adopt the location app – a newly released plug-in allows UK businesses to easily add a what3words address to their checkout page.

Series D: remaining £46m (£76m already raised) – please contact Nick – nick@oceanwall.com for further information.

Upcoming Events – Webinar

Opportunities in the Psychedelic Sector – Doug Drysdale, CEO of Cybin talks with Nicky Grant of Ocean Wall about the opportunities in the psychedelic space and why the recent price weakness has led to selective opportunities for investment.

Date: Thursday 26th May 2022

Time: 5pm

To register – please click here

This email is intended solely for the addressee(s) and may be legally privileged and/or confidential. If received in error please delete it and all copies of it from your system, destroy any hard copies of it and contact the sender. Any unauthorised use or disclosure may be unlawful. The accuracy or completeness of this email is not guaranteed. Any opinion expressed in this email may not necessarily reflect the opinions of Ocean Wall Limited. Any personal information contained in this e-mail is provided solely for the purpose stated in the message. All emails may be monitored in accordance with legal requirements contained in Regulation of Investigatory Powers Act, Data Protection Act, Telecommunications Regulations Act and Human Rights Act.

This email is not an offer or a solicitation to buy or sell any security. It should not be so construed, nor should it or any part of it form the basis of, or be relied on in connection with, any contract or commitment whatsoever. It is not an advertisement to an unlimited group of persons of securities, or related financial instruments. The email does not constitute a personal recommendation and the investments referred to may not be suitable for the specific investment objectives, financial situation or individual needs of recipients and should not be relied upon in substitution for the exercise of independent judgement. Past performance is not necessarily a guide to future performance and an investor may not get back the amount originally invested. The stated price of any securities mentioned herein is not a representation that any transaction can be effected at this price. Ocean Wall Limited, or its respective directors, officers, employees, and clients may have or take positions in the securities or entities mentioned in this document.

Each email has been prepared using sources believed to be reliable, however these sources have not been independently verified and we do not represent it is accurate or complete. Neither Ocean Wall Limited, nor any of its partners, members, employees or any affiliated company accepts liability for any loss arising from the use of the Report or its contents. It is provided for informational purposes only and does not constitute an offer to sell or a solicitation to buy any security or other financial instrument. Ocean Wall Limited accepts no fiduciary duties to the reader of this email and in communicating it Ocean Wall Limited is not acting in a fiduciary capacity. While Ocean Wall Limited endeavours to update on a reasonable basis the information and opinions contained herein, there may be regulatory, compliance or other reasons that prevent us from doing so. The opinions, forecasts, assumptions, estimates, derived valuations and target price(s) contained in this material are as of the date indicated and are subject to change at any time without prior notice.

The views expressed and attributed to the research analyst or analysts in the email accurately reflect their personal opinion(s) about the subject securities and issuers and/or other subject matter as appropriate. Information that is non-factual, interpretive, assumed or based on the analyst’s opinion shall not be interpreted as facts and where there is any doubt as to reliability of a particular source, this is indicated.