2020 will obviously be remembered as the year of the dreadful Covid-19 virus, but it should also be remembered as a year of significant triumph for modern science. In retrospect, the extraordinary speed of the development of a vaccine for Covid-19 can be attributed amongst others to two key factors. The first was pressure – the adage that necessity is the mother of (scientific) invention. The second is that scientific centres like Oxford University were working on vaccines for similar viruses before the emergence of the pandemic. Oxford showed again it was at forefront of research. This month we look at how investors can participate in Oxford’s pioneering research in such fields as genomics, AI, fintech and quantum computing.

Last May, we looked at four holding company trades – Schroders UK Public Private, Pershing Square, Doric Nimrod 2, and Yellow Cake. Our thesis on these trades was based on robust underlying assets, dislocation, and a chance to pull to par. All have tightened their discount with price performance Doric +48%, Pershing is +26%, Yellow Cake +17% whilst Schroders is unchanged. This month we look at the second widest amongst all 400 UK Listed Closed-ended funds with a 10-year total NAV performance amongst the top 20; Tetragon.

With a Brexit agreement secured we look at a potential bounce-back infrastructure reflation trade in Costain – a stock that has not properly recovered since its ill-timed asset raise last Spring.

The Covid-19 Pandemic has accelerated the transition to a new way of working and this, in turn, is creating new opportunities and adaptations that are providing exciting investment opportunities – with technology being front and centre of this wave. In February we will be hosting the legendary Doug Atkin, ex CEO of Instinet – arguably the original Fintech company, on how to capitalise on The Future of Work – see below for further details.

This Spring we are eagerly anticipating the IPO of UK unicorn Darktrace with a mooted £3.8bn valuation. Another ‘one to watch’ is potential UK unicorn: what3words– a company that continues to grow and dominate the geospatial industry. This month we are pleased to welcome CEO Chris Sheldrick at our January family office event (details below) as they launch their Series D.

Oxford University – opportunities for investors from the UK’s super brand

Back in April, Oxford University announced it was partnering with AstraZeneca on the development and distribution of a potential Covid-19 vaccine (CovAdOx). That vaccine, developed by Oxford University’s Jenner Institute in collaboration with Vaccitech, received approval from the UK medicines regulator at the end of last year and offered an unalloyed triumph for the UK government. Matt Hancock described it as “moment to celebrate British innovation”.

Vaccitech is a portfolio company of Oxford Science Innovation. Back in July Ocean Wall hosted Andre Crawford-Brunt, the largest shareholder in, and a board member of, Oxford Sciences Innovation (OSI). OSI was set up in 2015, raising £600 million in capital by striking a unique deal with the Oxford University, whereby OSI and the University share an equal and automatic stake in all qualifying spin-out investment opportunities that originate from the University. To date, 75 companies have been spun out of the University via OSI and the goal is to spin out 10 to 15 companies per annum.

OSI is currently closed to new capital but in the presentation enclosed Andre talks about how one can still participate in investment opportunities that have potentially exponential future value from the number one research university in the world.

Investing in a Thousand Years of the Future – Oxford Sciences Innovation

Tetragon – a 54% discount to NAV

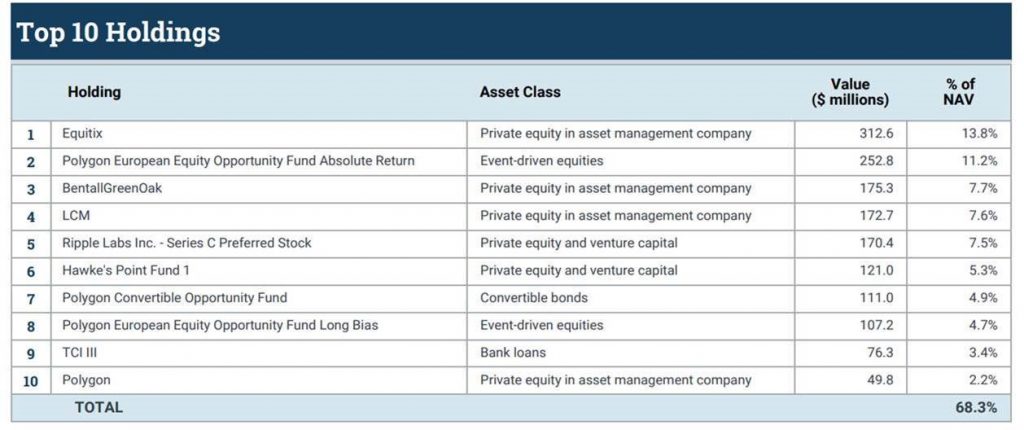

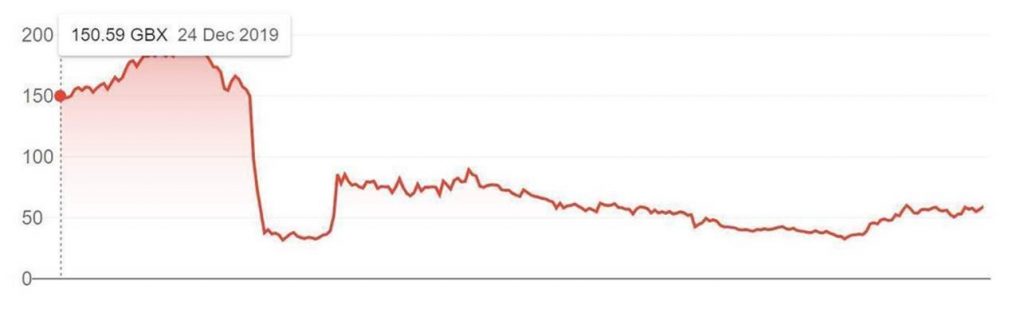

Tetragon is a closed-ended investment company that invests in a broad range of assets; public & private equities and credit (including distressed securities and structured credit), convertible bonds, real estate, venture capital, infrastructure, bank loans and TFG Asset Management, a diversified alternative asset management business. It is isn’t for everyone as the lack of voting rights as the lack of voting rights on the ordinary shares keep management in control. As well as that above market charges have deterred investors (1.5%/25%). Nonetheless the discount to NAV is chronically wide at 54%. This is unchanged from March when JPMorgan Cazenove described the discount as ‘unprecedented’ for a company that had grown net asset value by 294% since flotation in 2007, or 11.7% a year.

The portfolio is an interesting mix of funds and private equity. Tetragon portfolio

Tetragon has high insider ownership of over 32% so is essentially a quoted family office investing in multiple assets classes which makes it comparable with similar more highly rated vehicles such as RIT Capital Partners which trades close to its NAV. With a dividend yield of 5.2% and dividend cover of 2.2x it looks a compelling Hold co trade.

Costain – UK value post Brexit agreement

Costain is one of the UK’s leading smart infrastructure solutions companies, operating across the strategically important transportation, water, energy, and defence markets. Few firms will look back on 2020 with fondness, with Costain perhaps least of all. It had costly lost adjudication decisions and a rights issue at maybe the worst possible time in the last decade. It announced plans to raise £100m in new shares on 11th March, close to the end of a one-week period when stock markets around the world plunged as the pandemic took hold.

In the five days after Costain announced its rights issue its shares fell 75%.

Net cash now stands at around £140m and the balance sheet looks healthy. The shares are almost a third of their value from this time last year and market cap is £162m with the shares at 59p.

This year, surely, will be better on every front for the company. It is well capitalised, it will (it hopes) not repeat the raft of negative adjudication decisions and is well-placed to benefit if the expected ramp-up in infrastructure spending materialises.

The thing is, Costain is not short of work. The group has a £4.2bn order book, with getting on for £1bn of that confirmed for next year. Costain is now focusing on higher-margin consultancy services, with a particular interest in digital solutions. Its highways solutions have benefited from renewed investment commitments from the UK government. Infrastructure projects, like HS2, will be an important tool in kick-starting any economic recovery.

Last March, the government committed to investing £600bn in UK infrastructure over the next five years. Costain also looks set to benefit from the move towards a carbon-free society after developing its decarbonisation solutions. The group is involved in several noteworthy projects, involving carbon capture and storage, hydrogen, and biogas.

With a Brexit agreement secured this could be the bounce-back infrastructure reflation trade.

The Future of Work

Companies are rapidly adapting to the future of work through remote working, utilising the growing independent contractors/gig economy, using technology to source talent and scale/develop workforces and automation of business processes using AI and machine learning. These changes bring increased flexibility and cost savings to companies – especially in terms of their workforce.

Meanwhile the workforce is also adapting; the rise in remote and independent contractors/gig economy (increased from 11% of the workforce in 2005 to an estimated 40% in 2020) working is bringing more freedom and flexibility in all aspects of their work life. It is worth noting that Millennials are close to accounting for 50% of the workforce and they have grown up with the expectation of regular career changes, workplace mobility and ubiquitous technology.

These accelerating changes are providing opportunities for new marketplaces, software solutions and worker benefits. Companies can grow at extremely high rates and some have already reached scale – Zoom, Fiverr and Upwork – but there is a plethora of emerging players with new products and services. And whilst some work practices will revert to pre-Pandemic status – there are many industries and professions that will change permanently, with numerous companies committed to working remotely going forward, e.g., Twitter, Hitachi, Zillow.

There are several Venture Capital specialists now in this sector and investing with companies who can identify these start-ups at an early stage is key to a successful strategy. Remote work and gig economy stocks have outperformed throughout the pandemic and particularly in the private market, there is a great opportunity to selectively invest in the same theme at reduced valuations. https://communitascapital.com/

Date for your diary:

Subject: The Future of Work – Doug Atkin of Communitas Capital

Date: Wednesday 3rd February

Time: 3pm (UK)

Opportunity to hear Doug Atkin of Communitas Capital discuss The Future of Work. Communitas Capital – the unique FinTech VC firm – was founded by three former public company CEOs – all of whom have been investors, operators, and financial service industry pioneers – they bring a unique opportunity to partner with and invest in some of the most exciting and impactful FinTech and marketplace companies.

Please email nicky@oceanwall.com to pre-register.

what3words – bringing the goal of universal standard ever closer

what3words continue to dominate the geospatial industry and the end of 2020 has seen the company take ever increasing steps forward in its bid to become the de-facto standard location address in the UK and Germany – two of its focus countries. In October they partnered with HERE Technologies – who are the world’s leading navigation platform and found in 150 million vehicles worldwide – to provide drivers with this highly precise navigation tool. what3words also finished off the year with announcements that Royal Mail are now partnering with Drone Prep Skyports to deliver parcels and post using w3w location addresses to remote areas in the Scottish Islands and leading private hire company Addison Lee and transportation database WikiRoutes are now using w3w addresses to give more precise journeys. In Japan, Hitachi Solutions and what3words have partners to offer precision location capabilities to thousands of organisations.

what3words take its social responsibility seriously and they are also helping make the world a more accessible place for wheelchair users – working with accessibility apps like EYE-D, GoodMaps and Aira – to guide users to wheelchair ramps and lifts. Venues such as O2 are also using w3w to give clearer location information of ramps, lifts, and other facilities.

Reminder:

Subject: what3words

Date: Wednesday 20th January

Time: 11am (UK)

Ocean Wall are delighted to welcome Chris Sheldrick, Co-Founder and CEO of what3words for a presentation of their cutting-edge precise location app.

Please email nicky@oceanwall.com to get Zoom log in details.