Though we may want to hibernate, events do not give us that luxury. Expectations are that we will be elf isolating this Christmas.

At Ocean Wall we stick firmly to niche alternatives and in this missive there will be minimal mention of Covid and the US election other than to say I was flabbergasted that almost £95m was already matched on Betfair ahead of November. Like the national polls, current Betfair odds translate to 54% Biden and Trump 44%. Survation showed last week that of money managers in charge of $3tn of US assets, 60% think Biden will win. Despite Trump’s current income tax debacle, the outcome may not be so clear cut. One US fintech CEO I spoke to last week, who is a Democrat, said that sadly Trump will win as there are too many “ashamed Trump supporters” in swing states.

In this ‘Some thoughts’ we look at Special-purpose acquisitions companies (SPACs) as US SPAC issuance in 2020 has been almost as big as IPO issuance. The question addressed is why the profile of SPACs is so low in Europe.

We look at the recent surge in European mid cap M&A as well as an opportunity in one of the holding company trades that we highlighted in June.

Last week the UK biotech, Compass Pathways, was the first pure play psychedelics company to go public on a major American exchange. Riwa Harfoush, who is an advisor to Ocean Wall, looks at the potential for psychedelics to go mainstream.

Lastly the price of uranium strengthened by over 40% between March and May due to Covid-induced supply warnings from Kazatomprom and Cameco. From its June high of $34lb we address the frustration that the uranium price has slipped back to $30lb despite the news flow continuing to be positive.

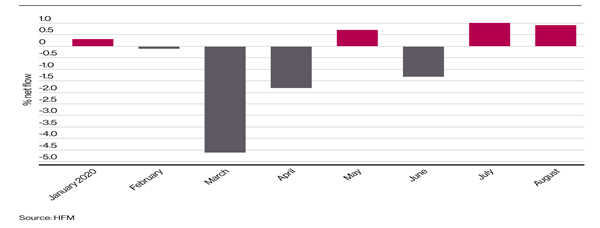

Before starting it is worth noting that hedge funds continue their recovery from heavy redemptions in March and April with another month of net inflows taking it to three from four up to August. Only three strategies, global equity, distressed and mixed arbitrage, had net outflows; managed futures, macro and event-driven proved most popular.

European SPACs – rarer than hens’ teeth

Back in 2008 I worked on the first German SPAC which was imaginatively called Germany1 Acquisition Ltd! It came across my desk as arbitrage focused hedge funds were particularly interested in the value of the warrants and the ability of the management to close on a transaction.

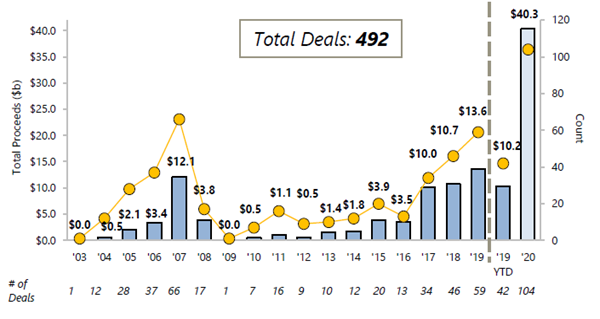

SPACs in the US have raised $40.3 billion so far in 2020 compared with $13.6 billion during the whole of 2019, according to Dealogic. By comparison US companies raised $51.3 billion this year through traditional initial public offerings, roughly on a par with all of 2019. The chart from BTIG below shows the sudden take-off. SPACs this year have completed 47 acquisitions totalling $50.2bn vs 22 deals totalling $15.1bn last year.

For those that do not know a SPAC is a publicly listed acquisition vehicle, whereby a sponsor raises a blind pool of capital with the specific purpose of acquiring a private or public operating business. The Sponsor’s role is to generate value for its shareholders and partners, by sourcing, structuring, and transacting at an attractive price. Following the completion of the business combination, the SPAC structure effectively falls away, and the entity continues to trade and operate as a traditional public company. As well as arb fund the investor appeal is quite broad from yield focused funds interested in downside protected investments to fundamental and sector dedicated institutional funds looking for underappreciated companies in their space right back to private investors looking for strong growth but denied access to the private equity space.

Despite record SPAC issuance in the US, in the twelve years since Germany1, Europe hasn’t been bitten by the SPAC bug. According to Dealogic data there have been no listings of SPACs in Europe this year.

One would have thought that in Europe, given the volatility in the markets amid the coronavirus crisis, blank cheque companies would have become a more attractive way to go public. For corporates it has the benefits of triple track for exits with IPO, M&A or SPAC.

In the US high profile names like Nelson Peltz and Bill Ackman have helped the visibility of SPACs and the simple truth is that in Europe there is a smaller number of sponsors or people who have the traction or the visibility to raise the same amount of money. Even those that have a strong track record and name, eg Richard Branson, would rather raise capital in the US.

There are also structural variances between SPACs in the US and in Europe, particularly in the UK which make it more difficult to raise funds from investors. In the US, shareholders get to vote on the acquisition and if they do not want to invest in a specific target, they can redeem their shares. However, in the UK this is not a feature of the structure. For sponsors, this actually provides more certainty that they can execute an acquisition more quickly – which would make listing in the UK more attractive in theory. I remember in my time at DB that the specified time period for initial capital deployment and the additional execution complexity of the structures put equity investors off.

Going forward there is no doubt that SPACs could be an option in Europe for those sponsors struggling in this tougher fundraising market as it allows them to turn to the public markets in search of a wider pool of potential investors.

One sign of life is Martin Franklin, a well-known blank-check sponsor, currently raising c.$750 million in an IPO of Harvester Holdings Ltd. to list in London. His argument for a LSE listing:

Mr. Franklin favours the UK market for SPACs in part because the rules prevent investors from redeeming their investment in the vehicle. That provides an advantage competing for targets with strong profits and cash flows by assuring the seller that the deal can be financed without risk.

Covid-19 has created the opportunity for the European SPAC market. Now it just needs a high-profile name/team with a compelling investment proposition, a track record and cornerstone capital to get the ball rolling.

M&A – European mid cap activity picks up

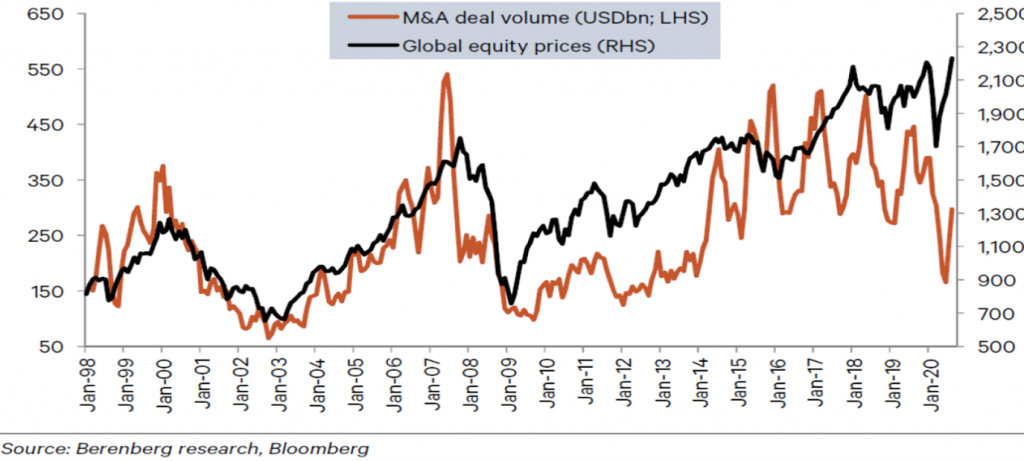

Global M&A is lower than 2019 due to the lockdown months but July and August in terms of deals have surprised on the upside. The link between corporate confidence and deal activity has left M&A spreads lagging despite the rally from March lows, as the chart illustrates:

The stress from March drove a dislocation in merger arbitrage that is still offering an opportunity set comparable to late 2008. Technical unwinding of risk by certain event funds led to spreads temporarily trading at dislocated levels in March.

In March, the annualised spread was 114% across 60 names that tightened to 51% in July. With an average 8.3% gross return this is notably higher than even late 2008.

Although spreads have tightened wider spreads and inefficiencies still persist. Not all deal risk is equal, and this presents an opportunity as merger arb is about buyer intent, strategic logic, and the basis of legal contracts vs a broad-based view of the market environment.

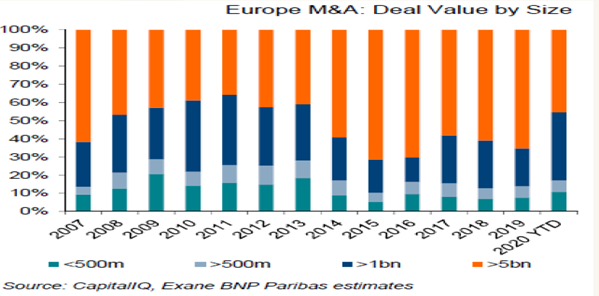

With the upcoming Presidential elections, it is likely US M&A will quieten. European M&A activity has picked up dramatically and European mid caps have significantly increased by proportion, as the chart below illustrates:

Holding companies – pull to par

Back in early June’s ‘Some Thoughts’ I discussed crisis alpha in dislocations in four listed holding companies that each offer compelling ‘sum of the parts’ returns.

Discounts to NAV have been the perennial problem for holding company management teams. The expectation is that ‘the good will out’ and that arbitrageurs and value investors will step in and create a natural pull-to-par. If that does not work, then management have the buy-back mechanism. As a last resort there is the ‘take private’ option or M&A.

Although the discounts have tightened in each of the Doric Nimrod Air 2, Pershing Square Capital and Yellow Cake, one of the hold companies Schroders UK Public Private Holding has yet to move. In December Neil Woodford’s Patient Capital Trust was taken over by Schroders and renamed Schroder UK Public Private (SUPP). Schroders made an initial £268.3m write down on the largest 11 unquoted stocks in the portfolio and then a subsequent write down at the start of May. This was trading on a 43% discount to NAV in June compared to its then 50.4p NAV.

The new managers of the former Woodford Patient Capital investment trust have insisted its finances are coming under control and that there are concrete signs of value in the portfolio which provide a route to tackling its huge borrowing.

SUPP’s shares today trade at 27.5p, less than a third of the launch price five years ago and similar to when Schroders got the job, also reflecting a 42% discount to recently cut NAV of 46.1p per share. 60% of the early-stage companies are in the healthcare sector including Oxford Nanopore, which accounts for 12% of the portfolio and is tipped for IPO in early 2021.

SUPP has also raised cash from its stake in the smartphone payment system, Yoyo Wallet. More importantly, the cancer care specialist, Rutherford Health, which is SUPP’s largest holding at 19% of portfolio, claims to have used its proton beam therapy to treat more than 100 patients and agreed with NHS Shared Business Services to care for others via NHS trusts.

SUPP’s second-biggest stake, at nearly 18% of NAV, is Atom Bank, which has been approved as a new lender under the government’s Coronavirus Business Interruption Lending Scheme. Atom Bank doubled the size of its loan book to £2.4bn in the 12 months to March. The company raised £50m in July ahead of a mooted IPO in late 2021 or early 2022.

With the NAV having been cut 4x times in two years this a case of “what more bad news can I tell you that you don’t already know?”

More info can be found on the Schroders website but the underlying assets have been Covid beneficiaries and as businesses like Oxford Nanopore and Atom Bank approach IPO there are meaningful catalysts on the horizon.

The Psychedelic Renaissance

Mental illness is the hidden global pandemic. By 2030, global mental health costs are expected to increase to $6 trillion with depression growing to be the biggest global disease burden. The way we are approaching mental health is simply not working – it has become the costliest condition in modern medicine and there has been no improvement in treatment efficacy for over 70 years. Within a care paradigm in desperate need of innovation, the emerging renaissance of psychedelics suggests a new approach to mental health, offering a beacon of hope to millions worldwide.

Though considered controversial today, humans have been using psychoactive compounds in spiritual, healing and communal contexts for millennia. Academic research into both entheogenic (naturally occurring in plants) and synthetic (derived in a laboratory) drugs has been ongoing since the late 19th century, but was stifled for decades due to misinformed and reactionary policies that led to punitive drug rescheduling, the “War on Drugs’, bans, prohibitions and enduring social stigma.

After going underground for years, we’re approaching an interesting tipping point in the psychedelic renaissance. A surge in new academic research groups (John Hopkins Centre for Psychedelic and Consciousness Research, Berkley’s Psychedelic Science Centre, Imperial’s Psychedelic Research Group) activism (Decriminalise Nature, The Beckley Foundation, MAPS) and conversations in the public sphere (Michael Pollan’s How to Change your Mind, Fantastic Fungi) are changing perception, driving regulatory change, evolving the views of governments and public health authorities and creating tangible opportunities for the investment community to participate in the burgeoning of a true growth industry.

One company leading the way is Compass Pathways, a UK biotech engaged in Phase IIb clinical trials to show efficacy of their patented synthetic psilocybin (the naturally occurring psychedelic chemical found in magic mushrooms) regarding treatment-resistant depression. Compass is the first pure play psychedelics company to go public on a major American exchange. On the first day of trading the share price jumped 71% from an open of $17 to a close of $29 and the company raised $127 million in an effort to bring their drug to market. Compass’s 34 million outstanding shares are valued at almost $1 billion.

Though Compass has yet to achieve FDA approval (some anticipate a 2-3 year timeline), the landscape is evolving rapidly with several federal, state and local initiatives seeking to reclassify psychedelics.

Compass shows strong initial performance and is certainly not alone amongst a growing number of biotech companies exploring psychedelic therapeutics, as well as technology companies responding to unmet needs across the treatment arc. We look forward to watching this space evolve for the benefit of both investors and society at large. (Riwa Harfoush, advisor to Ocean Wall)

Uranium – hold the line

The price of uranium squeezed up over 40% between March and May due to Covid-induced supply warnings from Kazatomprom (KAP) and Cameco (CCJ). From its June high of $34lb there is some frustration that the price has slipped back to $30lb despite the news flow only improving.

Spot purchases in the uranium market usually run around 5m lbs a month however this rose to 11m lbs in March and 22m lbs in April. The vast majority of this was bought by producers and intermediaries replacing lost production and not utilities entering the market. The spot market should remain tight and prices should remain supported. KAP announced on 19th August that they will be flexing down production by 20% through 2022. KAP also need to purchase 9-11m lbs in the spot market during the remainder of 2020.

Tier 1 mining closures from KAP and CCJ, depleted inventory levels and lingering supply chain issues have caused the largest primary supply side deficit on record.

We are now entering a period of the strongest ever political support for nuclear and with that uranium is becoming a rebirthed de-carbonisation play. With low emission targets being set aggressively globally, nuclear has renewed support.

In the Biden Plan for a Clean Energy Revolution the Democrats have a section called “Identify the Future of Nuclear Energy” which advocates nuclear via small modular reactors. This is the first time since 1970 that both US parties are pro nuclear.

China’s nuclear power industry will maintain steady growth in the 14th Five-Year Plan period (2021-25), and it is expected to add 6-8 reactor units each year, according to a blue paper by the China Nuclear Energy Association published in the summer. China is now the biggest platform in the world for the deployment of nuclear power technology.

Demand is set to see a pickup in 2021 as contract coverage ends for c.50% of utilities on their refuel cycle.

If utilities know this why aren’t they contracting now? On the recent Vimy Resources management call one nuclear power plant (NPP) head, when asked why he was not contracting uranium, said “we worry about tomorrow’s problems tomorrow.” Uranium is a small input cost in a reactor. To give some context the difference for a nuclear power plant between paying $35lb or $55lb is 0.125cents per Kw/h.

If you have a NPP with a $6bn capital cost that uses 1m lb of uranium pa then you are paying $30m pa and you will not baulk at paying $60m or even $120m pa. Uranium is completely price inelastic as without uranium a plant closes and the restart costs would run into the hundreds of millions of dollars. Uncertainty of supply was the reason why the uranium price rallied 5x between 2005-07.

Also, NPPs have had other reasons to hold off entering the market. They have needed to ensure their own operations, first through COVID, but they are also facing uncertainties through the Russian Suspension Agreement extension as well as the US election.

As to start of procurement, many NPPs receive new budgets on October 1st that allow them to go forward with contracts they have been negotiating over the past year. Covid has upset the usual networking that goes on at WNA in September, and NEI in October, so this year there is a lack of the usual gatherings that tend to influence buying schedules. What the impact of that will be is another unknown but fundamentals are now the tightest they have been whilst the number of uranium sector stocks has dropped from 600 in 2007 to c.50 publicly-traded names today and their commensurate market cap has fallen from $140bn to $11bn.

With so few companies left will all boats float when the uranium price spikes?

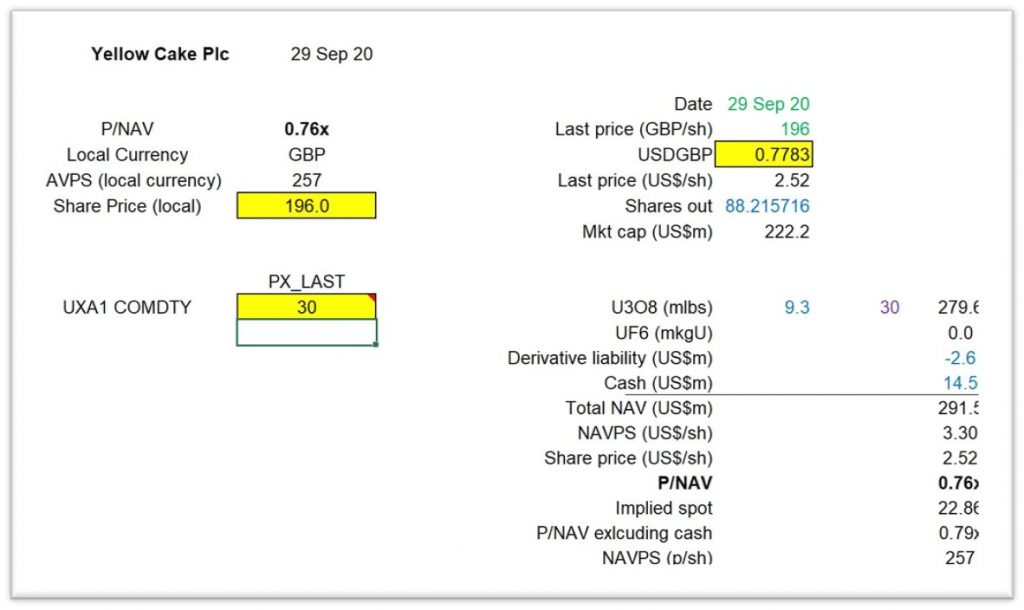

One can get convexity from the uranium miners such as UEC, FCU and EFR but for the safer delta one play we prefer Yellow Cake (YCA) who sequester uranium. The enlarged buyback has another 15 business days at the current average rate of 57,000 shares a day. The buyback on average represents 17% of daily volume. By the end of August, the NAV discount had tightened to 11% but has widened out again to 24% with the recent USD rally to 1.28. Model below:

Some more info on the Ocean Wall website on Yellow Cake and on uranium.